The fundamental underpinning of normative economic theory is the axiom of rationality which in layman terms means that individual consumers at any one time act in their best interests (rationally) to achieve maximum utility in consumption decisions. It is the premise upon which consumer theory is built.

Or maybe, not?

The axiom has come under heavy scrutiny as a result of the advent of a new branch of economics, behavioural economics. This contemporary strand which is a union of cognitive psychology with economics and finance contests the empirical validity of the idea that consumption choices made by individuals are a direct consequence of a rational train of thought and to think in that way is overly simplistic. Even the christened godfather of economic theory Adam Smith in his pioneer work on economics – The Wealth of Nations– ever so slightly hinted that as per observation, individuals many times consumed goods and services in line with romantic aspirations that are often not consistent with the tenets of rationality.

Alan b. Krueger in his introduction to the Wealth of nations’ quipped, “People are usually rational decision makers although sometimes seduced by romantic hopes to disregard the dangers inherent in their decisions. In a very real sense the origin of behavioural economics, an emerging field in economics that questions whether individuals act rationally to maximize their individual utility can be traced back to Adam smith”

Scholarship

Dan Arielly a behavioural finance and business administration professor at Duke University recently published a deeply insightful book called ‘Predictably Irrational’. I daresay I developed a sneaking affection for his logic and simplicity and most intimately his creative experimentation. In it he conducted various experiments that proved that individuals in their consumption decisions are decidedly more prone to being irrational than they are aware of or are willing to admit. What makes this irrationality in decision making even more foreseeable is that it has foundation in our neurobiological predispositions as humans that are almost impossible to detect and even more difficult to control.

I will give you the broad strokes of a few experimental tricks Arielly used to expose the fallibility of human rational thought in arriving at economic decisions.

Example A:

Consider this offer for annual subscription of the daily monitor, the Ugandan news daily

- Print version—————— 150.000

- Online version—————-100.000

- Print AND Online version–150.000

Now basing on your preference and your desired form of delivery you would look to either have it in print or online. However, it was discovered that those with an original leaning towards online version given perhaps they belong to the mobile age will gravitate towards getting the option for both print and online because at face value it feels like a steal. That is regardless of the fact that they do not need it but given that there is a DECOY which is the more expensive print version being priced the same as having both, it hoodwinks the mind into assuming having both comes at a bargain and marshals them towards choosing the third option. It takes time to internalize but this tact was employed to great profit by the economist newspaper in the UK as a marketing ploy. The results were astounding. As is evident in this case, irrationality prevailed.

Example B:

Respondents are given two items that they would in a hypothetical situation be in a position to purchase. These are a SUIT that costs 500 $ and a trouser that costs 50$ sold in different shops. When asked whether if they were made aware of a cheaper option by a margin of 7$ for both items in a nearby store, respondents were more willing to go and purchase the trouser at the cheaper store than they were willing to do for the suit. Conventional wisdom suggests that an item that has a lower absolute cost should require lower commitment to save on given that it is cheap, a suit which is more costly should elicit a higher propensity to want to save the 7$ in question. What takes place here is that 443 $ and 450$ seem more easily reconcilable than a 43$ and 50$. Such a decision brooks little application of active mental faculty but brings to light how an irrational characterization of dissimilarity in marginal cost can lead to a less than optimal decision which in this case is to be less willing to go to a cheaper shop for a suit than a trouser even though the suit is more expensive. (In absolute terms)

This, suffice to say, is a drop in the bucket as far as scholarship in this new groundbreaking field is concerned. As with discovery of new knowledge, the new literature is legion given the mad dash by economic scholars worldwide not to miss out on the new frontier for understanding consumer behaviour through the prism of a mix of rational and irrational actions in studying the complex social phenomena involved to advance our knowledge in consumer decision making and economics as a discipline in general.

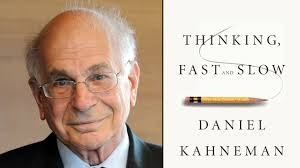

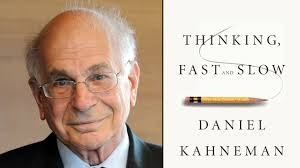

Other recommended readings include the works of Nobel Laureate Daniel Kahnemann-‘Thinking Fast and Slow’-whose work in cognitive psychology has important lessons for understanding economic actors’ decisions and how they deviate from rationality. His experimentation is more elegant and slightly exhibitionist in some cases but overall lucid empirical argumentation concerning the human condition in relation to economic environment. The evidence is all very compelling and I invite everyone interested in a deeper understanding of human thinking capacities in decision making to explore his and other publications in the field.